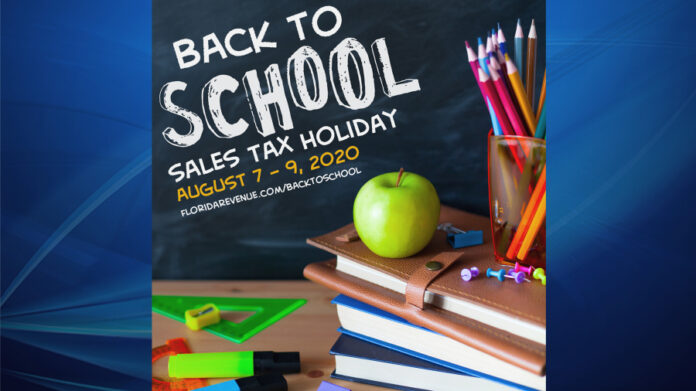

Courtesy: Florida Department of Revenue

TAMPA, Fla. (WFLA) – The back-to-school sales tax holiday is right around the corner and we’ve got all the details as to what the holiday does and does not apply to.

The 2020 sales tax holiday will begin on Aug. 7 and will end on Aug. 9.

During the three-day period, no sales tax or local option tax will be taken on purchases of:

- Clothing, footwear, and certain accessories selling for $60 or less per item

- Certain school supplies selling for $15 or less per item

- Personal computers and certain computer-related accessories selling for $1,000 or less per item, when purchased for noncommercial home or personal use

The sales tax holiday will not apply to:

- Any item of clothing selling for more than $60

- Any school supply item selling for more than $15

- Books that are not otherwise exempt

- Computers and computer-related accessories purchased for commercial purposes

- Rentals or leases of any eligible items

- Repairs or alterations of any eligible items

- Sales of any eligible items in a theme park, entertainment complex, public lodging establishment, or airport

For a full list of items that are exempt or taxable during the sales tax holiday timeframe, check out the pictures below.

LATEST NEWS FROM WFLA.COM:

Trending Stories